The San Francisco Foundation uses professional money managers and an independent investment consultant to invest the assets entrusted to us. Diligent stewardship and strong performance mean that together, we can make a greater impact in the Bay Area and beyond.

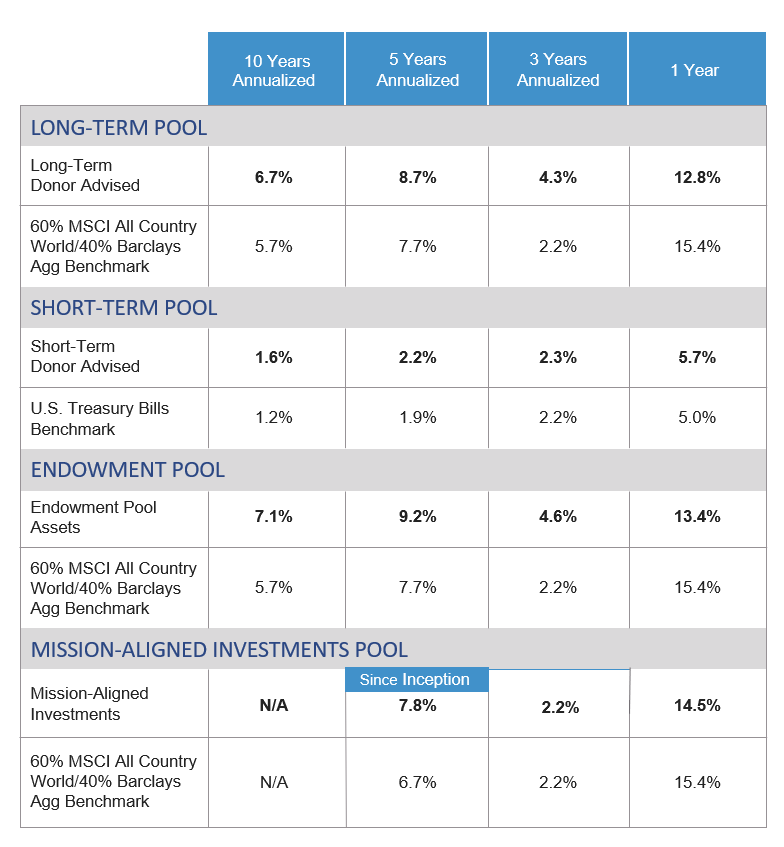

The following table illustrates our pools’ performance over time, net of fees (as of December 31, 2023):

Actual fund returns may vary from the pools’ performance results above, depending on the timing of a specific fund’s contribution & grantmaking activity.