While the foundation offers several types of funds to choose from, a Donor Advised Fund (DAF) makes it easy to support the causes you care about in the Bay Area, across the United States and around the world. What is a DAF? Donor advised funds are non-endowed funds that offer an active approach to philanthropy. Why open a DAF? Donor advised funds are ideal for donors wanting to give to multiple organizations and programs throughout the year, and any time you wish. Donor advised funds provide a strong alternative to establishing a private family foundation. What is the gift amount to open a DAF? The minimum gift to open a Donor Advised Fund is $10,000.

The process of opening a Donor Advised Fund:

Give

- Open your fund with a charitable contribution of $10,000 or more and qualify for an immediate tax deduction.

- Contribute cash, securities or complex assets, such as real estate and closely held stock.

- Add to your fund any time.

Grow

- Select from a variety of investment options and watch your charitable dollars grow. In addition, you can also choose to invest a portion of your DAF in our Bay Area Community Impact Fund, which provides nonprofits with low-interest, long-term loans. The goal is to finance high-impact projects that align with our racial and economic equity agenda in underinvested communities.

- Recommend an outside investment manager for funds valued at over $2.5 million.

- Maximize your charitable dollars with our competitive investment performance.

Grant

- Support 501(c)(3) nonprofits of your choice anytime.

- Access information about your fund and recommend grants 24 hours a day on our secure, online portal

- Involve generations of family members in your giving if desired.

Additional Information

Annual Fees

Because we are a public charity, administrative fees support the foundation’s commitment to building a better Bay Area. Fees are charged directly to our donors’ funds. We charge an annual support fee based on a tiered schedule for a blended, effective rate.

| First $0-$3 million | 1.00% |

| Next $3 million-$10 million | 0.75% |

| Next $10 million-$25 million | 0.50% |

| Next $25 million | 0.25% |

| Minimum annual fee | $500 |

Investment management fees are assessed by individual managers and fluctuate over time as market values change.

Tax Deductions

| Tax deduction limits for gifts of cash | 60% of adjusted gross income |

| Tax deduction limits for gifts of appreciated stock or real property | 30% of adjusted gross income |

| Tax deduction limits for gifts of closely held stock | Deduction at fair market value |

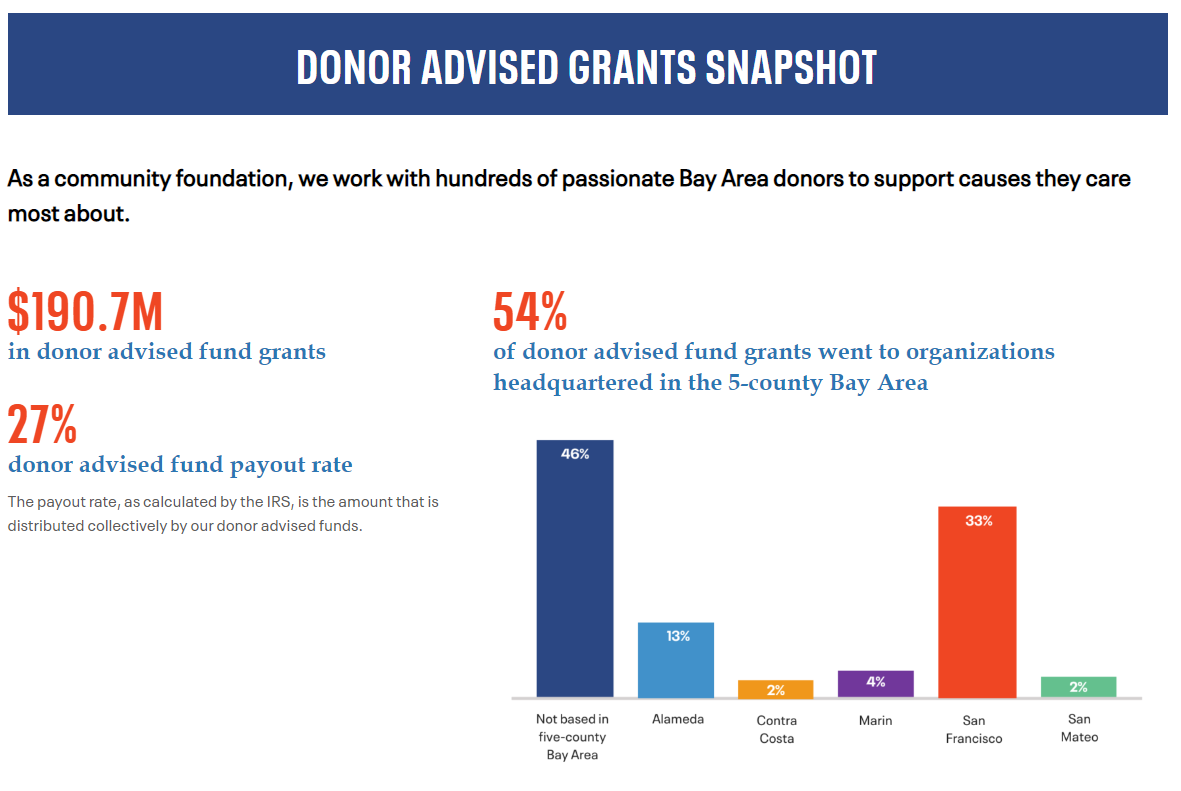

Donor Advised Fund Grants By the Numbers

Want to open a fund?

- Download our donor advised fund agreement.

- Contact Pamela Doherty at (415) 733-8521 or pdoherty[at]sff.org.

Frequently Asked Questions

How do I open a donor advised fund?

You can establish a fund by completing a donor advised fund agreement and making a charitable contribution of at least $10,000. You’ll receive an immediate tax deduction and can start recommending grants right away.

How do I choose a name for my fund?

Many donors use their family name to name their fund. Another option is to select a different name, such as the “Main Street Fund,” to protect your confidentiality. When you recommend a grant through the online Donor Center, you may also elect to include or omit the name of your fund that accompanies the payment to the nonprofit.

Who can oversee my fund?

In the case of a donor advised fund, you manage your fund’s grantmaking activities. You may choose to designate your spouse or partner, your children, other family members or a friend as additional primary advisors to your fund. And you may engage future generations by naming successor advisors.

What are the guidelines for recommending a grant from a donor advised fund?

Fund grant recommendations can be made to nonprofit 501(c)(3) organizations in good standing. The foundation verifies the nonprofit status and charitable mission of the recommended organization. The minimum grant is $250. You may recommend grants to nonprofits within the region, throughout the U.S. and abroad. The IRS does place some limitations on grants from donor advised funds. This type of fund cannot fulfill any pledges you may have made. Similarly, since you will have already received a full deduction for the amount contributed to your fund, donor advised funds cannot be used for tickets to events such as fundraising events, galas or for memberships that include any goods or services in return.

How do I recommend a grant?

Once you have established a fund, you may make your recommendations through the Donor Center. You can also use our Grant Recommendation Form to relay your wishes in writing and send to us to process on your behalf. Donors may recommend grants that provide general support to nonprofit organizations to support a particular project, a scholarship fund or other purposes. Grants may be made in honor or memory of someone you wish to acknowledge.

Grant checks are accompanied by a transmittal letter identifying the donor advised fund by name (unless anonymity has been specified). You will receive a copy of this letter through the Donor Center.

How can the foundation help guide my giving?

While some donors are well-informed about the causes and organizations they wish to support, others avail themselves of our expertise in identifying priority needs and worthy organizations in the Bay Area and beyond. We can help you design a personalized giving plan and assist you in maximizing the impact of your philanthropy. Foundation donors receive our newsletters and annual reports that highlight timely issues and community challenges and opportunities. Donors are invited to foundation events, educational forums, site visits and neighborhood tours.

How are funds invested?

All of the foundation’s funds are professionally managed and overseen by the San Francisco Foundation’s Investment Committee and Board of Trustees. Our overall investment strategy is to provide prudent management of invested capital while producing a reasonable return for grantmaking and fund growth. When you establish a donor advised fund, you can choose from several investment allocation strategies, including short term, long term and a socially responsible investment portfolios.

How can I track the activity and investment returns associated with my fund?

You will receive quarterly statements of your fund’s activity, available in the Donor Center, six weeks after each quarter’s close. You may also access your fund’s monthly statements online, view your fund balance, the status of your grants and your giving history.

How can I include my fund in my estate plans?

Your estate plan is an important and powerful tool that can be used to provide for both your loved ones and your favorite charitable organizations after your lifetime. Review our fact sheet to learn more about how to Include a Donor Advised fund in Your Estate Plan.