The San Francisco Foundation joined with donors, fundholders, and partners for the 2022 Investment Forum on March 14. The annual event was an opportunity to provide stakeholders with an update on SFF’s investment strategies and performance in 2021, and its continued work to strengthen how investments support the equity agenda.

The forum began with an introduction and acknowledgments from SFF’s Chief Executive Officer Fred Blackwell, who highlighted the importance of recognizing our progress in meeting our financial and social impact goals despite global events in the backdrop of the day’s discussion.

SFF’s Approach to Investing

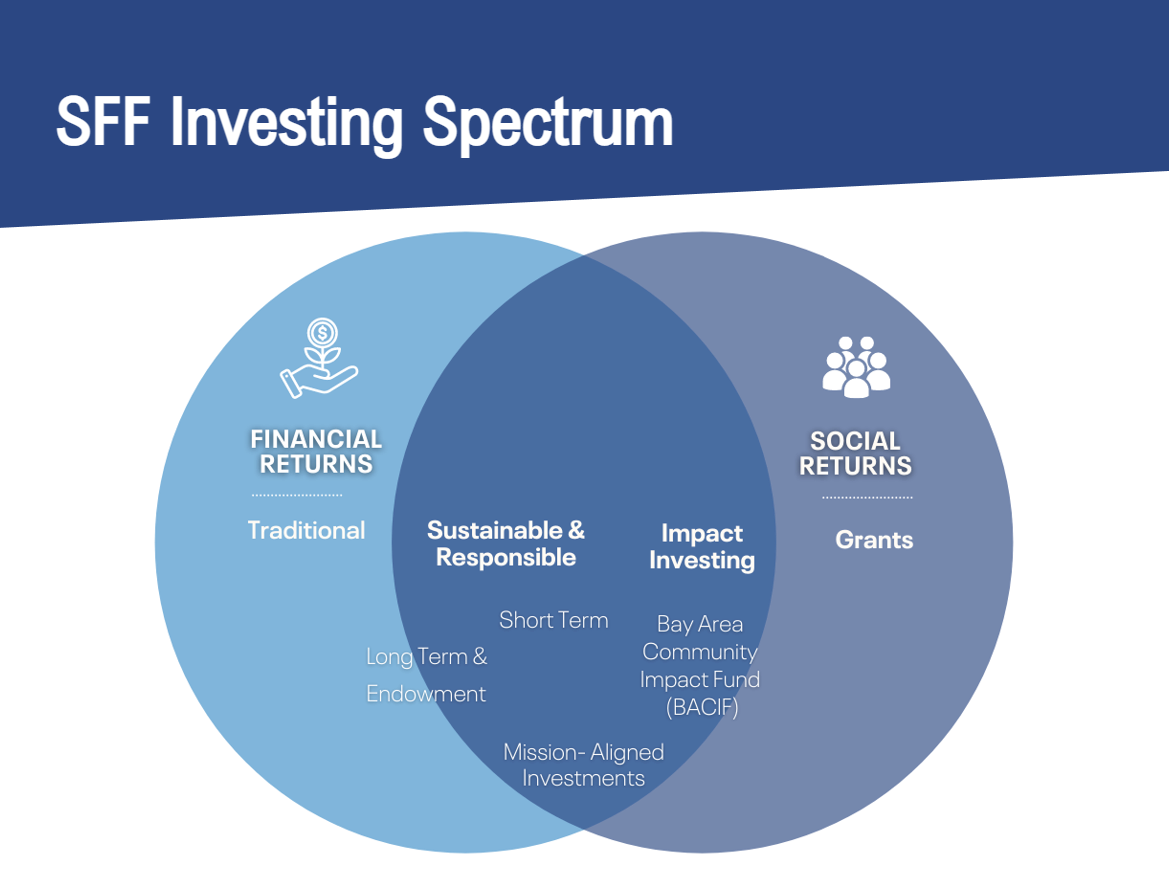

Mark Doherty, SFF’s Senior Director of Investments, provided an overview of how SFF manages, invests, and allocates assets entrusted to the Foundation with racial equity and economic inclusion at the center of the investment process, noting “In previous decades, endowments and foundations really had separate strategies to achieve financial and social returns. We have been trying to be intentional as an institution to increasingly allocate capital to investments that do both.”

Doherty underscored that “We are not foregoing returns in our effort to overlap these two and generate social returns. Our endowment continues to be a top decile performer over ten and 15 year periods versus other endowment foundations.” Michael Miller, Chief Investment Partner, Crewcial Partners provided more detailed information about the Foundation’s top-level performance, which he underscored is founded on having long-term strategies, establishing a collaborative model, and using the Foundation’s scale to our advantage.

Impact Investing

- Mission-Aligned Investments pool: Three years ago, we launched this pool with $50 million from our endowment with the explicit goals of generating financial and social returns. Over 70 donor funds have joined this effort, and the pool has grown to $120 million.

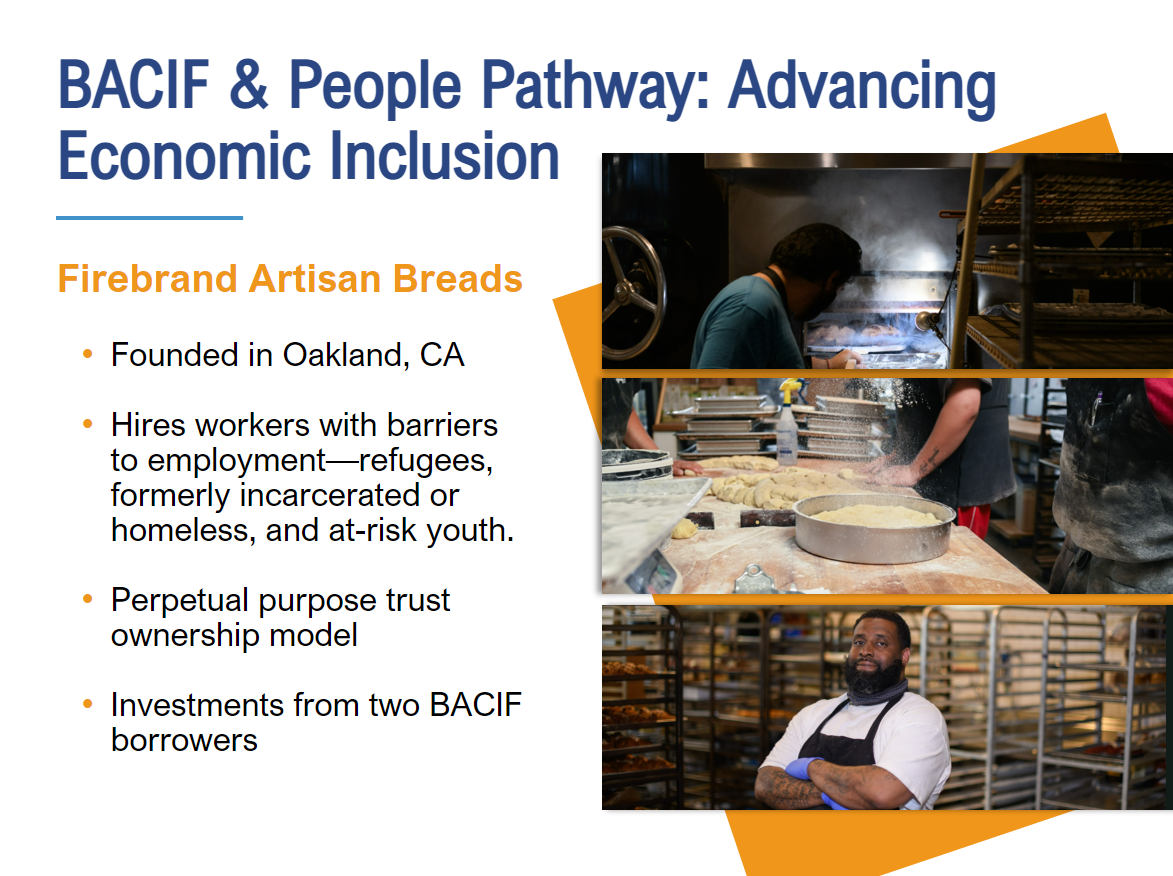

- Bay Area Community Impact Fund (BACIF): BACIF is a $25 million program-related investment fund charged with generating maximum social impact via long-term low-interest loans to nonprofits addressing racial and economic equity in the Bay Area. A case study was shared in the Forum highlighting two loans BACIF had made to ICA and REDF which then invested in Firebrand Artisan Breads to help scale its business. The owner of Firebrand created an innovative ownership structure that provides profit sharing for employees, a pioneering example of economic inclusion.

See the full presentation from the 2022 Investment Forum.

The second portion of the forum transitioned to a fireside chat about how managers can achieve financial returns while driving social returns.

David ibnAle, SFF Trustee and Managing Partner at Advance Ventures Partners, moderated a discussion with Adeyemi “Ade” Ajao of Base10 Partners, and DeShay McCluskey co-founder AltraVue Capital both of whom are investment managers for SFF.

Ms. McCluskey shared her approach with companies to ensure their incentives align with long-term value creation, saying, “We actively engage with really great managers and superior capital allocators to have their incentives align with long-term value creation. “We take the approach of not withholding capital but injecting capital to be an active participant by making ourselves available, talking about impact, or being available as a resource for board member seat recommendations, job candidates for senior leadership teams, or [simply] having regular conversations. When you have these conversations, you bring these [ESG] issues to the forefront, and they can’t hide from it so they need to come to you with some results, process, or plan of action.” She described how current social issues have made having conversations easier with companies in a way that was unimaginable before. “It is fantastic that the current has become much bigger in an authentic way, whereas it was more about box-checking in the past. Now, those two things are not at odds with superior investment returns.”

As venture capital firms have started embracing their role in addressing social issues, Adeyemi “Ade” Ajao discussed why brand and reputation are important and how the industry is starting to lean forward. “Brand matters now. There is not a single venture firm that has not taken a public stance related to issues of diversity or impact now. The [lack of] effort is getting called out by entrepreneurs and people in the Twittersphere asking, ‘What have you actually done?’ The general trend when it comes to measurement and reporting is making it so that your brand and reputation are slowly becoming one of the same,” said Ajao.

Using our Resources to Support our Mission

The forum highlighted the success of SFF’s investment strategies and how collaboration with its donors, fundholders, and partners continues to act as a catalyst for change in the community. The foundation encourages other investors to follow its approach of allocating to diverse managers and generating strong financial and social returns all while centering racial equity and economic inclusion so communities can thrive.

The 2022 Investment Forum presenters included:

- Fred Blackwell, CEO, San Francisco Foundation

- Mark Doherty, Senior Director of Investments, San Francisco Foundation

- David ibnAle, SFF Trustee, and Managing Partner, Advance Ventures Partners

- Michael Miller, Chief Investment Partner, Crewcial Partners

- Adeyemi “Ade” Ajao, General Partner, Base10 Partners

- DeShay McCluskey, Co-Founder & Managing Partner, AltraVue Capital

Watch a recording of the 2022 Investment Forum.

Learn more about how SFF’s investments impact communities in the Bay Area and beyond.