Turning personal wealth into community wealth

Opening a Donor Advised Fund (DAF) at the San Francisco Foundation (SFF) brings you into a powerful, bold, and active community of Bay Area philanthropists wanting to make a difference here at home, across the country and around the world.

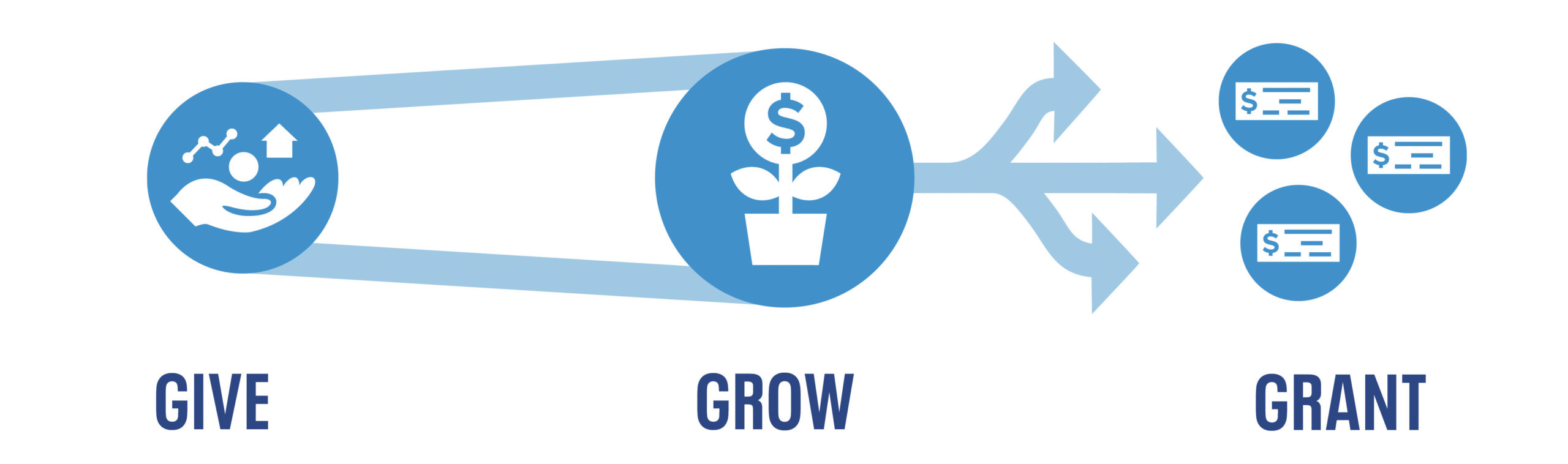

A Donor Advised Fund is a flexible charitable giving tool used by individuals, families, foundations, corporations, and nonprofit organizations. It allows you to focus on supporting the causes you care about while enjoying immediate tax benefits. We streamline the administrative process and provide grantmaking expertise to help you maximize your impact and realize your philanthropic goals.

Benefits

Streamlined Giving

You can create a named fund with $10K using a variety of assets, then make grants from the fund at your convenience through our online portal without worrying about recordkeeping and organizing paperwork. All the information you need to track your giving, grantmaking history, and fund activity is at your disposal.

Personalized Service and Expertise

Our Donor Services team and Philanthropic Advisors will work closely with you to design a customized giving plan and assist you in strategic grantmaking.

Donor Community and Connections

We offer donors a variety of opportunities for learning, engagement, and impact. Donors are invited to in-person and online foundation events, educational forums, grantee convenings and neighborhood tours. Through these gatherings, you can connect with like-minded peers from throughout the region. Donors also receive our newsletters, Giving Guides and annual reports that highlight timely issues, and community challenges, and philanthropic opportunities.

Superior Investment Management

Because we provide oversight of the investment of your fund, you have access to three investment portfolios and benefit from our top-tier investment managers, an industry-leading investment consultant and our Investment Committee. Our investment performance is in the top decile for 10-year annualize returns for foundations and endowments across the country.

Leader for Racial and Social Justice

If you have an interest in social justice issues here in the Bay Area, SFF offers considerable expertise, data, resources and tools to help inform your grantmaking and civic involvement. We are dedicated to advancing racial equity and economic inclusion, and believe the future of the Bay Area depends on our collective ability to ensure that everyone can participate, prosper, and reach their full potential.

Bay Area Knowledge

Our expertise in Bay Area grantmaking means that we have in-depth information to share about organizations that are working hard to make our region an even better place to live. As a community foundation, we work closely with nonprofits that are dedicated to improving the quality of life in underserved communities throughout the region. Whether you are interested in funding the areas of education, arts and culture, climate change, social justice and more, we can offer resources and connections to support your grantmaking.

Corporate Philanthropy Solution

DAFs are often strong alternative to establishing a private or corporate foundation. If you are a local business or association, you can set up a DAF and benefit from our knowledge of the Bay Area, our grantmaking expertise and guidance, and the administrative support we offer through our online donor portal and our Donor Services team.

Framework for Family Giving

DAFs are a great tool for involving family and the “Next Gen” in philanthropy. Our experienced Philanthropic Advisors offer a variety of techniques to inspire, encourage and engage the next generation of philanthropists in giving for positive social change. We work with families and with individuals who been named Successor (fund) Advisors to carry on charitable interests and intentions into the future. In addition, many families prefer to use DAFs rather than private foundations to streamline their efforts and fulfill their goals for philanthropy.

Impact Investment Options

We invest our assets in alignment with our values to generate positive social returns, as well as strong investment results. You may wish to allocate a portion of your DAF to our Mission-Aligned Investments Pool, which is comprised of a diversified portfolio of managers using a variety of impact investment and socially-responsible strategies, including social screens and Environmental, Social and Governance (ESG) considerations. Donors can also participate in our Bay Area Community Impact Fund by making a program-related investment (PRI) from their DAF to enable the foundation to make loans to local nonprofit organizations and social enterprises.

I knew that I wanted the funds in my DAF to be put to work for historically marginalized communities in the City, but I didn’t know how to start. I’m a white donor and can’t always see where my own perspective and experiences limit the possibilities – not only of where the money from my DAF goes, but how I support and build community with the folks of color in San Francisco doing really powerful work. [The workshop] connected me with important ideas about how my DAF can make a difference, helped me to see how I can change my own behaviors, and put me in contact with other donors who are trying to affect change, too.

Aubrey Mailliard Rawlins, Fund Holder

Open your fund with a contribution of $10,000 or more and qualify for an immediate tax deduction.

Contribute cash, cryptocurrencies, securities, or complex assets, including real estate and closely- held stock.

Select from a variety of investment options and watch your charitable dollars grow.

Recommend an outside investment manager for funds valued at $2.5M+

Support 501(c)(3) public charities of your choice anytime through our secure online portal.

We set up a small fund to learn the inner workings, challenges and possibilities of DAFs as a possible mechanism to redistribute wealth in more equitable ways and see if there were others out there with similar questions and hopes. We are grateful to have met others at/through SFF who are similarly focused on cultivating more just societies – mobilizing and leveraging what we can.

Jane Pak, Fund Holder

How to Open a Donor Advised Fund

Contact Us

Contact our Gift Planning Department to discuss your goals. Email give[at]sff.org, or call (415) 733-8521

Complete Fund Agreement

Fill out and email the fund agreement to us. Our team will review it within one business day.

Make Your Contribution

Once your fund agreement is complete, you can use a variety of assets (cash, securities and more) to make your initial charitable contribution to the fund. The minimum is $10,000 to get started.

My friend, Deborah Santana, encouraged me to partner with San Francisco Foundation to create my donor advised fund, The Black Harvest Fund. Black farmers need assistance now more than ever. SFF made the process seamless.

Natalie Baszile, Fund Holder

Additional Information

Because SFF is a public charity, administrative fees support the Foundation’s commitment to sustainable, community-driven solutions for building a better Bay Area. Once established, assets held in the fund and invested in our portfolios are subject to the administrative and investment fees. See a summary of our fees.

You manage your fund’s grantmaking activities. Donors/advisors can make grant recommendations through our online portal Donor Center. For each grant you can decide whether to opt for privacy by giving anonymously.

You will receive quarterly statements of your fund’s activity through Donor Center. You may also access your statements online, view your fund balance, the status of your grants, and giving history.

Our minimum grant amount is $250. Grants can be recommended to public charities – nonprofit 501(c)(3) organizations within the region, throughout the U.S., and abroad. The foundation verifies the nonprofit status and charitable mission of the recommended organization. By law, Donor Advised Funds cannot fulfill any pledges you may have made. DAFs may not be used for event tickets or memberships that include any goods or services in return, since you have already received the full deduction for the amount contributed to your fund.

Your estate plan is an important and powerful tool that can be used to provide for both your loved ones and your favorite charitable organizations after your lifetime. Many donors choose to include the San Francisco Foundation and their funds in their estate plans. Refer to our fact sheet for additional guidance: Include a Donor Advised fund in Your Estate Plan.

The Foundation encourages fund holders to be active grant makers to ensure that charitable dollars benefit our communities. If a fund has no grantmaking activity for more than two years, the Foundation will notify the fund’s Primary Advisor and offer guidance and support. If we are unable to make contact, we will initiate a $250 grant from the fund to the Foundation to support our work in the Bay Area. If the fund remains inactive for another year (for a total of three years of inactivity), the fund may be closed and distributed following the instructions for the “Disposition of Fund Assets” outlined in the donor’s fund agreement.

The San Francisco Foundation has an unwavering commitment to equity and a just and inclusive society. As such, the Foundation will not approve or make grants to organizations deemed to be hate groups or engaged in hateful activity. If you would like more detail, please contact the Foundation at: donorservices[at]sff.org.