Did you know that SFF has invested in nonprofit projects and BIPOC-owned small businesses since the 1980s, long before the term impact investing was even coined? As we celebrate our 75th anniversary this year, we’re sharing an update on SFF’s investment strategies and performance, and our continued work to strengthen how investments advance racial equity in the Bay Area.

Investment Strategy and Performance

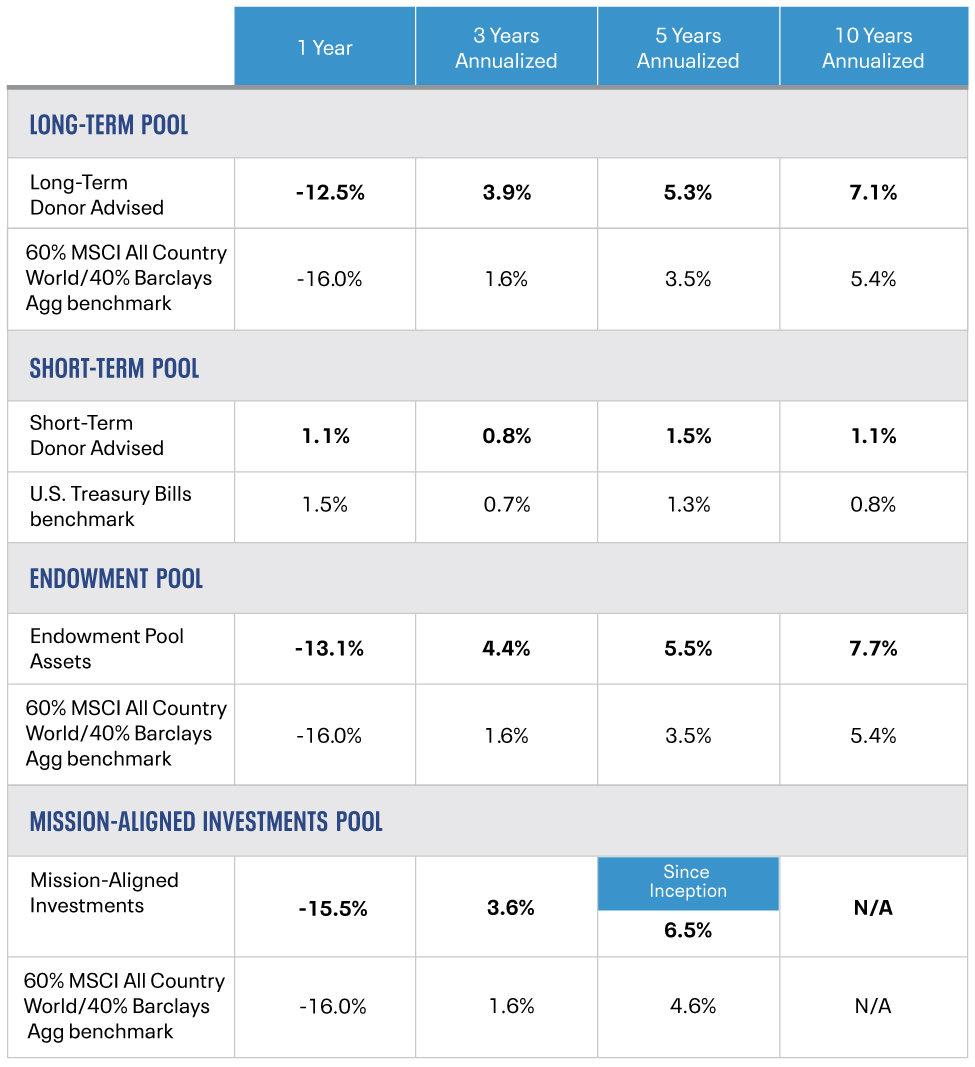

The foundation’s top-decile performance is founded on having long-term strategies, establishing a collaborative model, and using the foundation’s scale to our advantage, says Michael Miller, Chief Investment Partner at Crewcial Partners, SFF’s investment consultant. At the heart of SFF’s investment strategy is an ambition to allocate capital to managers whose strategies advance the foundation’s equity agenda while generating both financial and social returns.

Increasingly Diverse Investment Managers

To counter the near-total lack of diversity in the asset management business, SFF has made great strides in investing with diverse managers. Contrasted with less than 5% of assets invested by diverse managers globally, the foundation has invested 37% of its assets with firms that are majority-owned by women or people of color. This has resulted in less risk and greater returns for the foundation’s portfolios. “The Bay Area leads the nation in wealth inequality. There’s a need for systemic change,” says Mark Doherty, SFF’s Senior Director of Investments. “Investments play just one part in the foundation’s work along with fundholder partnerships, grantmaking, and policy advocacy.”

At SFF’s recent investment forum, two of our managers shared perspectives on diversity in their work.

One of our investment managers, Julie Lein, co-founder and Managing Partner of the Urban Innovation Fund, has built a venture capital firm with $250 million under management which invests in “smart cities” sectors like transportation and energy, as well as Fintech and Edtech, which also enhance the quality of life and economic vitality of cities. At Urban Innovation Fund, Lein shared, diversity runs through her portfolio: 80% of their funds having a woman or person of color on the founding team.

Another SFF investment manager, Gilbert Garcia, CFA and Managing Partner at Garcia Hamilton and Associates, has shared with us the challenge that diverse managers face when working through the diligence process with institutional investment consultants. As an advisory committee member for the SEC and Treasury departments, Garcia has made recommendations at the federal level to expand diversity across the asset management space.

SFF’s Road to Impact Investing

For 75 years, SFF has partnered with donors to pool their giving to meet the region’s needs. We’re immensely proud of the work that we’ve done – and continue to do – together with donors, investment managers, nonprofits, and policy partners, to improve life in the Bay Area. We look ahead to the next 75 years more dedicated than ever to seeing the Bay Area reach its full potential.

- 1948: SFF officially launched at the Sir Francis Drake Hotel in Union Square – with $20 in the bank.

- 1970: Partnered with the American Jewish Congress to assist BIPOC-owned businesses

- 1982: Seed funded a credit union (Northeast Community Federal Credit Union) to serve the Chinatown, North Beach, and Tenderloin neighborhoods.

- 1989: Designated 1 percent of our endowment for loan guarantees on behalf of nonprofit projects.

- 2000: Added a socially responsible investment option for donor advised funds.

- 2009: Earmarked $5 million of our endowment to making loans to nonprofits in the Bay Area.

- 2018: Committed an additional $10 million for Bay Area Community Impact Fund investments in local communities.

- 2019: Committed $50 million from our endowment to launch our Mission-Aligned Investments Pool, also available for donors.

- 2022: Expanded our impact investments by automatically allocating a portion of our two long-term investment pools to the Bay Area Community Impact Fund.

Learn more about SFF’s history at sff.org/anniversary.