Investing to Maximize Impact

We want to make the biggest impact possible on our community. That’s why we invest our assets in alignment with our values and with the long-term goal of generating strong investment results. We’re proud to offer a new Mission-Aligned Investments Pool, which uses a variety of socially responsible and impact investment strategies that support our commitment to racial equity and economic inclusion, whether by investing in firms led by women and people of color, who have historically faced barriers accessing capital, or by investing in companies whose work directly aligns with our commitment to equity.

As a foundation donor, you gain access to top-tier investment managers who generate exceptional returns, as well as the guidance of an industry-leading investment consultant and our Investment Committee. Diversity of our managers is a core consideration of our Investment Committee. More than 35 percent of our assets are invested by firms owned by women and people of color.

Investment Portfolios and Objectives

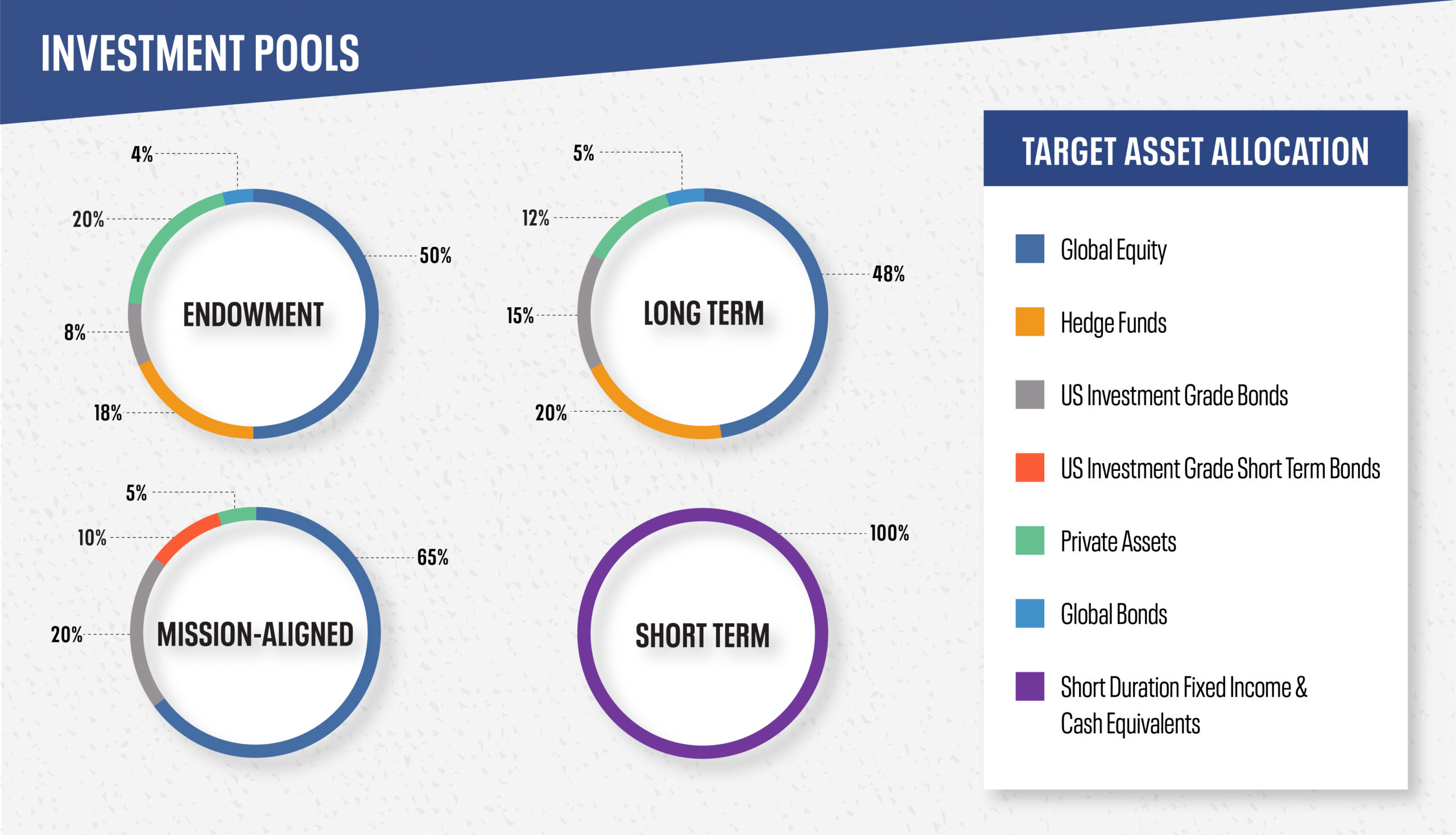

Donors have access to four investment portfolios to meet your grantmaking objectives. We set high standards for each portfolio, using institutional asset managers. We consider environmental, social and governance factors across all of our portfolios, which we believe contributes to strong performance. The portfolios’ asset allocation, risk and performance are closely monitored by our consultant, Investment Committee and staff.

Long-Term Pool

Designed for: Donor advised funds that will be granted out over time.

Investment objective: Diversified portfolio that includes global equity and fixed income, private equity, venture capital and hedge funds. The inflation-adjusted return allows for flexible and active grantmaking. To deepen our impact investment program, since July 2022, a portion of the Long-Term Pool is also allocated to the foundation’s Bay Area Community Impact Fund (BACIF). BACIF provides local nonprofits and social enterprises with low-interest loans to help advance racial equity and economic inclusion in the Bay Area.

Mission-Aligned Investments Pool

Designed for: Donor advised funds that will be granted out over time. Funds are invested with a values-based approach that aligns with the foundation’s commitment to racial equity and economic inclusion.

Investment Objective: Diversified portfolio seeking market rate returns in global equity and global fixed income using a variety of impact investment and socially-responsible strategies, such as social screens and environmental, social and governance considerations. Over time, illiquid investments, such as private equity, are being added to provide targeted social impact. This pool also allows for flexible and active grantmaking.

To deepen our impact investment program, since July 2022, a portion of the Mission-Aligned Investments Pool is also allocated to the foundation’s Bay Area Community Impact Fund (BACIF). BACIF provides local nonprofits and social enterprises with low-interest loans to help advance racial equity and economic inclusion in the Bay Area. Learn more.

Short-Term Pool

Designed for: The portion of donor advised funds to be used for near-term grantmaking.

Investment objective: Short duration portfolio that includes U.S. dollar denominated short-term, fixed-income securities and cash equivalents. The targeted return matches or exceeds inflation and avoids exposure to more volatile asset classes such as equities and alternative investments. The pool uses the same social screens as the Mission-Aligned Investments Pool, as well as environmental, social and governance considerations in its investment selection process.

Endowment

The foundation’s endowment pool consists of a collection of permanent, unrestricted and designated funds established over time by many generous donors through outright gifts and bequests. Nonprofit organizations also create endowment funds with the foundation to generate an enduring source of income for their missions.

Designed for: Permanent funds aiming to maintain grantmaking power in perpetuity.

Investment objective: Diversified portfolio that includes global equity and fixed income, private equity, venture capital and hedge funds. The target inflation-adjusted return is consistent with our annual distribution rate of approximately 5 percent.

Bay Area Community Impact Fund

This program-related investment fund enables the foundation and donor advised funds to make impact investments in organizations and projects that align with our commitment to racial equity and economic inclusion. By providing nonprofits and social enterprises with access to low-interest, long-term loans, this fund enables organizations to expand their activities and finance high-impact projects. Better yet, as loans are repaid, the fund makes new investments, recycling capital back into communities. Learn more.

Investment Managers

We implement our strategy through index funds and active investment managers. Working with our investment consultant, Crewcial Partners, we closely monitor performance, adherence to strategy, and the risk exposures of each manager. New managers are added to improve diversification and enhance the prospective performance of the portfolio.

With Crewcial Partners, we seek out and evaluate firms owned by women and people of color to ensure that our managers represent a diverse set of strategies, views and backgrounds. We have more than $580 million invested with diverse managers.

We have established asset allocation targets consistent with the investment objectives of each portfolio. Actual allocations are managed within the range outlined in our investment policy.

We believe our allocation policies lead to long-term success in meeting investment objectives under a variety of market conditions. Market timing is not part of our investment philosophy. Learn more about our investment performance.