In my seat as Director of Investments for the San Francisco Foundation, I see the financial repercussions of our country’s racist legacy. A report by Citigroup last year found that $16 trillion has been wiped from the US economy over the last two decades as a result of discriminatory laws. While two-thirds of white families invest in the stock market, only one-third of Black families do so.

In the asset management industry, only 1.3% of assets under management globally are overseen by firms that are majority-owned by women or people of color, according to a report by the Knight Foundation. The industry’s near-total lack of diversity aggravates wealth disparities that disproportionately prevent people of color from thriving. Not only do diverse-owned firms perform as well as their non-diverse counterparts, but they are also more likely to invest in entrepreneurs of color.

As a community foundation, we combat these inequities and impact the communities we serve through our grantmaking, our work with donors, and our policy advocacy. Another powerful tool we use to advance our equity agenda is how we invest the funds that have been entrusted to us, including our endowment.

In March, we held our annual Investment Forum to share with our donors and community partners how we manage, invest, and allocate the foundation’s assets while centering racial equity. Through our investments, we advance racial equity and economic inclusion by allocating capital to communities of color and managing our capital through an increasingly diverse set of asset managers.

Investment Options Focused on Impact

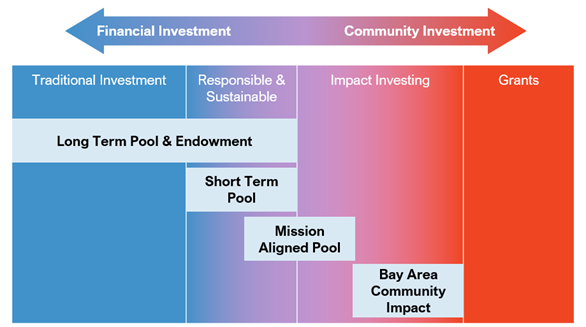

We provide a spectrum of investment choices for our fundholders that include socially responsible screenings, environmental, social, and governance considerations, and impact investment strategies.

Impact Investing

Fundholders seeking the strongest social impact should consider our Mission-Aligned Investments Pool, which seeks both a market-rate return and a positive social outcome, and/or our Bay Area Community Impact Fund, which provides low-interest-rate loans to local nonprofit organizations achieving targeted impacts that advance our mission in the Bay Area.

Two years ago, we launched our Mission-Aligned Investments Pool with $50 million from our endowment. We are thrilled to see that over 50 donors have joined us in this effort by allocating an additional $40 million to this pool. Last year, the pool invested $1 million in Urban Innovation Fund, a venture capital firm led by two women and focused on startups primarily led by women and people of color.

The Bay Area Community Impact Fund, a $25 million program-related investment fund, provides low-interest loans to nonprofits addressing racial and economic equity in the Bay Area. Most recently, we made a $900,000 loan to Oakland Community Land Trust that will help purchase and update single-family homes and small, multi-unit buildings in Oakland and preserve them as permanently affordable homes jointly owned by residents, building their wealth and leaving a nest egg for their families.

Diversifying Our Asset Managers

One of the most direct ways our investments advance equity is by putting them in the hands of diverse investment managers. An example of an investment that I am proud of is our $1 million commitment to Impact America Fund, the largest venture capital firm in America led by a sole Black female general partner.

For the foundation’s overall impact investing strategy, we are constantly striving to increase the percentage of our assets that are managed by women and people of color. At the end of 2020:

- 32% of our $1.5 billion in assets were overseen by asset management firms that were majority-owned by women or people of color.

- 23% of our asset managers were women-led; 12% were led by people of color.

- One-third of the managers approved by our investment committee in 2020 were majority-owned by women or people of color.

We are proud of the progress we have made and will continue to intentionally allocate capital to diverse managers across all asset classes.

Across the foundation, we are committed to our north star — advancing racial equity and economic inclusion — to ensure that everyone in the Bay Area has a chance to attend a good school, get a good job, live in a safe and affordable home, and have a strong political voice.

For more information about donor investment options at SFF, contact donorservices[at]sff.org.